NielsenIQ has revealed key insights into the new Australian grocery landscape, including details on Australia’s grocery price increases and key changes in grocery shopper behaviour.

The latest NielsenIQ research found 80% of shoppers believe their normal weekly shop costs more than it did six months ago. NielsenIQ data shows the average price per grocery item up six per cent versus last year and the average cost per meal up by $1.28 in the past 12 months.

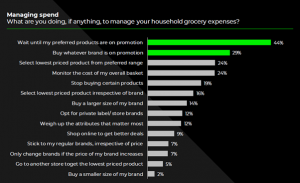

“Australians are using various strategies to manage grocery budgets with 44% saying they will wait until their preferred products are on promotion and 29% saying they will buy whatever brand is on promotion.”

The number of grocery items per shopping trip has also dropped as higher prices are making up for reduced volume in a fairly flat growth environment.

“People are buying less items in order to try and keep costs static,” says NielsenIQ, Pacific Managing Director Megan Treston.

“Inflation is certainly ramping up and consumers are feeling it. However, it’s important to understand that not all consumers are impacted in the same way and they are certainly responding very differently. Understanding and meeting the new needs of these various demographics and consumer groups will be critical in the next six-12 months,” she said.

Source: NielsenIQ.

More Australians shopping online

“The number of Australian households who shopped online for groceries has close to doubled and the value growth of online groceries sales grew 24% in the 12 months to June 2022. Online grocery shopping now accounts for 11% of all grocery dollars spent in Australia – up from nine per cent in 2021.

“As Australians prepare for continued retail transformation – one size does not fit anymore. Many consumers have embedded online shopping in their post-lockdown lives with one-in-three households adding this method to their repertoire.”

The outlook

NielsenIQ’s research confirmed that one-in-three Australians have concerns about their ability to meet daily expenses over the next six months.

“As a result, ongoing caution in consumer behaviours will accelerate for key groups. Affordability and value is the key preference but healthy living and waste reduction are still important.”

“Strategies need to evolve to help mitigate rising costs, cater to new consumer needs and lead industry change by embracing new technology and methods. Balancing price and promotions as well as developing an omni-shopper strategy will be critical for brand and retailer success in the back end 2022,” Ms Treston said.