Australian retail turnover rose 0.2 per cent in February 2023, according to figures released by the Australian Bureau of Statistics (ABS). This follows a 1.8 per cent rise in January 2023.

ABS Head of Retail Statistics Ben Dorber says retail sales rose modestly in February and appear to have levelled out after a period of increased volatility over November, December and January.

“Spending in food related industries continued to grow steadily in February, with cafes restaurants and takeaway food services up 0.5 per cent, while food retailing rose 0.2 per cent.”

“Non-food industry results were mixed as consumers continue to pull back on discretionary spending in response to high cost of living pressures,” Mr Dorber said.

Of the non-food industries, department stores rose 1.0 per cent in February, followed by clothing, footwear and personal accessory retailing (+0.6 per cent). Other retailing was the only industry to record a fall this month, down 0.4 per cent, while household goods retailing remained relatively unchanged (0.0 per cent).

Retail turnover rose modestly across most of the states and territories, with rises at 1.0 per cent or less. Queensland recorded the only fall in turnover, down 0.4 per cent.

“On average, retail spending has been flat through the end of 2022 and to begin the new year.”

Year-on-year, retail sales recorded 6.4% growth in February 2023 – bolstered by cafes, restaurants and takeaway, and food categories. Shoppers spent more than $35 billion across the country in February.

There were significant year-on-year sales increases for cafes, restaurants and takeaway (up 17.1%), food (up 7.9%), department stores (up 7.7%) and clothing, footwear and accessories (up 6.2%). Other retailing spending increased by 3.2% while household goods declined year-on-year by 2.3%.

ACT (up 9.2%) and Western Australia (up 8.7%) led the spending growth, followed by Tasmania (up 7.1%) and South Australia (up 7.1%). New South Wales (up 6.6%), and Victoria (up 6.1%) also recorded solid increases.

Australian Retailers Association (ARA) CEO Paul Zahra says sales growth in some essential categories like food is now close to neutral when inflation is taken into consideration however, other categories are performing well as people continue to enjoy their freedoms post pandemic.

“We’re certainly seeing the start of the spending slowdown as a result of the cost-of-living pinch gripping Australians, with household goods being the first discretionary category to continue to see a reduction in spend,” he said.

“Over the previous few months, spending growth has continued to gradually soften. We’re now at the point in essential categories like food where inflationary price increases are mostly driving retail spending growth.

“The categories to record strong spending growth were restaurants, cafes and takeaway, department stores and clothing, footwear and accessories – with the resurgence in getting out and about continuing to deliver solid results for this segment, which was heavily impacted previously by the pandemic,” Mr Zahra said.

He said it is a challenging environment for retailers, who are also managing rising costs, labour shortages and supply chain issues.

Australian Bureau of Statistics Retail Trade Data – February 2023

| CATEGORY | FEB 2022 | FEB 2023 | CHANGE |

| Food | $12842m | $13859m | +7.9% |

| Household goods | $5958m | $5821m | -2.3% |

| Clothing, footwear, accessories | $2805m | $2978m | +6.2% |

| Department stores | $1753m | $1888m | +7.7% |

| Other | $5193m | $5359m | +3.2% |

| Cafes, restaurants, takeaway | $4469m | $5235m | +17.1% |

| Total | $33023m | $35141m | +6.4% |

| STATE | FEB 2022 | FEB 2023 | CHANGE |

| Victoria | $8550m | $9068m | +6.1% |

| New South Wales | $10436m | $11125m | +6.6% |

| Queensland | $6774m | $7102m | +4.8% |

| South Australia | $2103m | $2253m | +7.1% |

| Western Australia | $3593m | $3907m | +8.7% |

| Tasmania | $660m | $707m | +7.1% |

| Northern Territory | $297m | $312m | +5.1% |

| ACT | $608m | $664m | +9.2% |

CreditorWatch Chief Economist Anneke Thompson says, overall, the increase in spending over the month, at 0.2%, was very subdued and will give the Reserve Bank of Australia (RBA) board at the very least a discussion point in support of a pause to monetary policy tightening in April.

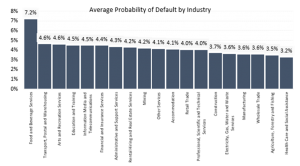

“The data reflects CreditorWatch risk metrics, which continues to place those industries which rely on discretionary spending at the top of the table in terms of probability of default. While we are yet to see a marked downturn in spending at cafes and restaurants, the upcoming winter could tell a different story as more Australian borrowers come off fixed rate loans and many household budgets will see a dramatic fall in excess money available for eating out,” Ms Thompson said.

Source: CreditorWatch BRI February 2023.