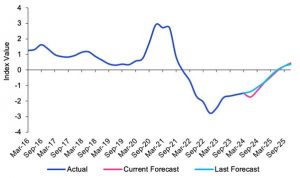

The latest KPMG Australia Retail Health Index (RHI) indicates another setback for the retail sector with a full recovery unlikely to occur before the end of 2025.

“Between March quarter 2024 and the June quarter 2024 the KPMG RHI further fell by 0.24 index points, moving from -1.49 to -1.73. The fall was primarily driven by higher producer prices and worsened consumer sentiment,” according to KPMG.

“Retail volumes and consumer sentiment continues to decline, as retailers bear the brunt of Australia’s two speed economy which sees renters and mortgage owners’ pair back spending while out right homeowners and older Australians continue to splurge.”

KPMG Retail Health Index, Actual & Forecast

Cashed up consumers spending overseas

Outright homeowners unaffected by interest rate increases are diverting their spending from in stores and local restaurants towards overseas travel.

KPMG Head of Retail & Consumer James Stewart says, “The post-Covid bounce in overseas travel appears to have reset spending patterns in the near term, with ‘cashed-up’ consumers seemingly preferring to allocate ‘big ticket’ spending towards overseas holidays and leisure rather than on major household goods.”

The number of Australian travellers increased by 7.3% in the 12 months to June 2024. This contrasts with weakened household spending on discretionary items which fell by 1% over the three months to the end of the June quarter and household savings which remain anaemic, well below the long-term average of around 5 to 6%.

KPMG estimates that per capita retail sales have now declined for each of the last 8 quarters, despite a significant rise in population growth including net overseas migration of 547,300 in 2023. Consumer sentiment also remains low and is the second weakest on record since the 1990’s.

“Unsurprisingly, discretionary retail is vulnerable as shoppers remain wary of acquiring major household items”, Mr Stewart said.

More discounting as retail profitability squeezed

Profitability for the retail sector is continuing to get squeezed as discounting-led sales activity is leading to reduced margins given operating constraints and wages continue to escalate.

While the decline in profitability in the retail sector was smaller than the overall industry profit drop of 3.9%, the retail sector’s contribution to total industry profit remained at just 4.7precent; well below its long-term average of 6.3%.

KPMG Chief Economist Dr Brendan Rynne says, “Retailers are currently weathering a perfect economic storm where consumer spending is down at the same time wages, manufacturing and operating costs are up.”

“The latest national accounts show industry gross value added (IGVA) has recorded 2 quarters of negative growth while food and accommodation has gone backwards over the past 3 quarters. So, while the economy is just holding onto slight growth, the retail sectors are absolutely in a technical industry recession.”

Retailers muscled out as consumers search for value on socials

Online retail continues to grow with non-food online penetration reaching 18.3% of total sales, up from 17.7% in the previous quarter.

“Marketplace platforms are also disrupting traditional shopping channels leveraging social media and supply chain models to cut out middleman retailers and allow consumers direct access to suppliers in their search for value,” according to KPMG.

“These platforms enable the consumer to buy directly from mostly Chinese factories at price points up to 60% less than they would otherwise pay in a store environment.”

“Social media platforms have changed the shopping pathway for consumers who are increasingly starting their discovery journey directly through social networks,” Mr Stewart said.