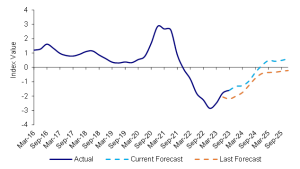

The latest modelling from the KPMG Australia’s Retail Health Index (RHI) indicates the retail sector will return to positive health by the end of 2024 as the cumulative impacts of higher population growth and moderating interest rates invoke a faster than anticipated bounce back.

“Between the June and September quarters 2023 the KPMG RHI rose by 0.18 index points, moving from -1.77 to -1.59; an improvement over the previous quarter but one that still suggests the overall health of the retail sector remains poor.

“New forecasts suggest the protracted downturn in the sector is no longer anticipated to stretch into 2025 as previously expected. By the end of 2024 it is now anticipated that the current strong population growth will be incrementally adding to retail sector demand more consistently; the interest rate cycle will have peaked and started to contract; and wealth effects associated with higher property prices will spur on consumption activity.”

KPMG Retail Health Index Q3 2023 forecast

KPMG Head of Consumer and Retail James Stewart says despite the positive long-term outlook, retailers are still concerned about the short term.

“Many discretionary retailers are worried about Christmas. The two-year holiday from discounting many retailers have enjoyed is well and truly over,” Mr Stewart said.

“Over the last two years consumers have been price takers rather than price makers, creating a margin bubble that was unsustainably good for many retailers.

“That bubble may not have burst yet, but it’s certainly under pressure and cost out and capex constraints are the name of the game, as retail CEOs seek to protect their promised results for shareholders.”

Adjusted for inflation, retail sales volumes rose 0.2% during the quarter – the first quarter of rising activity levels since 2022Q3. “Consumers are spending proportionally less on food and groceries, suggesting the ‘nice to haves’ are now being left out of the household shop,” Mr Stewart said.

“There was surprising sales strength in department store retailing (1.5% q/q), household goods retailing (0.8%) and clothing, footwear, and personal accessory retailing (0.5%) during the quarter. Other retailing (-0.4% q/q) and Food retailing (-0.3% q/q) experienced the only declines in spending activity during the quarter.”

Beyond bricks and mortar, online retail sales growth has reduced to modest levels (seasonally adjusted 2.1% in August 2023). “This is still strong in comparison to pre-pandemic levels as retailers are achieving much higher online sales with many discretionary retailers (non-food) regarding 25% as a sweet spot for online and offline sales channels.”