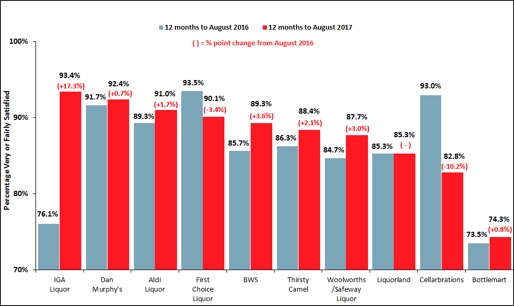

New research from Roy Morgan shows that customer satisfaction with IGA Liquor in the year to August 2017 was 93.4 per cent, putting it ahead of its major competitors. This is a major turnaround from a year ago, when it was ranked ninth and well behind the market leaders, First Choice Liquor, Cellarbrations and Dan Murphy’s.

The findings are from Roy Morgan’s Single Source Survey (Australia) of more than 50,000 consumers per year, which includes interviews with more than 8,000 customers of liquor stores and retailers.

Over the past 12 months, IGA Liquor improved its customer-satisfaction rating by 17.3 per cent points, well ahead of the improvement seen from its major competitors, with BWS the nearest (up 3.6 percentage points), followed by Woolworths/Safeway (up three percentage points) and Thirsty Camel (up 2.1 percentage points). Only two of the top ten stores showed declines in satisfaction over the last year – Cellarbrations (down 10.2 percentage points) and First Choice Liquor (down 3.4 percentage points).

These changes in satisfaction have now moved IGA Liquor to the top rating with 93.4 per cent of its customers satisfied, followed by Dan Murphy’s (92.4 per cent), ALDI Liquor (91 per cent) and First Choice Liquor (90.1 per cent).

Potential for increased liquor sales

Roy Morgan Research Industry Communications Director Norman Morris says improving customer loyalty is an issue for most liquor retailers, as it would provide a major opportunity for increasing sales.

“This is evident from the fact that, generally, on at least a third of purchasing occasions over a four-week period, customers purchase from a store that is not the one that they usually buy alcohol from,” he said. “This indicates a considerable degree of shopping around with insufficient incentive to consolidate liquor purchases with any one store.”

The opportunity to increase sales from existing customers also depends on the customer profile of each retailer.

“This research has shown there is considerable variation in the proportion of ‘big discretionary spenders’ across the major liquor retailers and, as a result, the propensity to achieve increased sales from existing customers will vary,” Mr Morris said.

Roy Morgan has developed a segmentation based on a person’s level of non-essential or discretionary expenditure, which includes purchases such as wine, travel, entertainment, etc. The top third of discretionary spenders are big discretionary spenders and so represent the largest potential for increased liquor sales.

The liquor stores and retailers with the highest proportion of big discretionary spenders in their customer base are First Choice Liquor (44.1 per cent of usual customers), Dan Murphy’s (43.1 per cent), IGA Liquor (41.8 per cent) and Liquorland (40.6 per cent).

The three major liquor outlets with the lowest proportions of big discretionary spenders are Thirsty Camel (26.1 per cent), Bottlemart (30.2 per cent) and ALDI Liquor (33.4 per cent).