Research from NielsenIQ has revealed important differences in the way Australia’s LGBTQ+ community spend on groceries and respond to grocery brand packaging and marketing.

With the research showing found that LGBTQ+ Australian households spent $4.5 billion on groceries during the 12 months to February 2022, the findings showcase the needs and wants of a critical and growing consumer group.

Passion over price

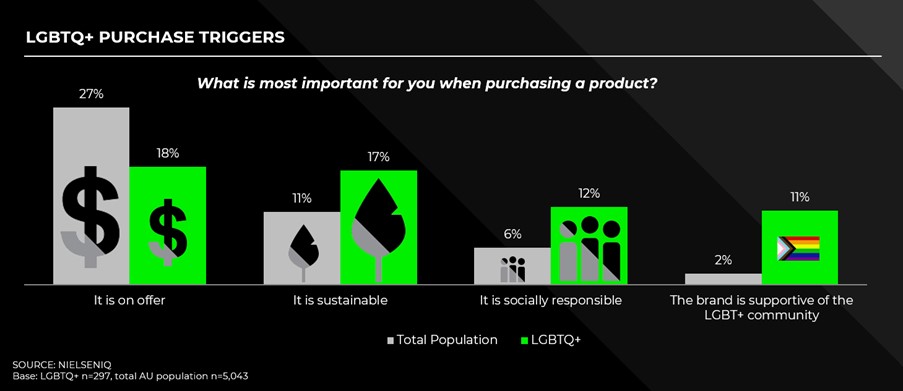

The research reveals that LGBTQ+ households are less driven by price promotions. Instead, these shoppers seek sustainable, socially responsible products.

“We know that the LGBTQ+ community cares more about and specifically seeks sustainable, socially responsible products compared to the general population,” says NielsenIQ’s Pacific Managing Director Megan Treston.

“They are less concerned with price promotions.”

Health matters

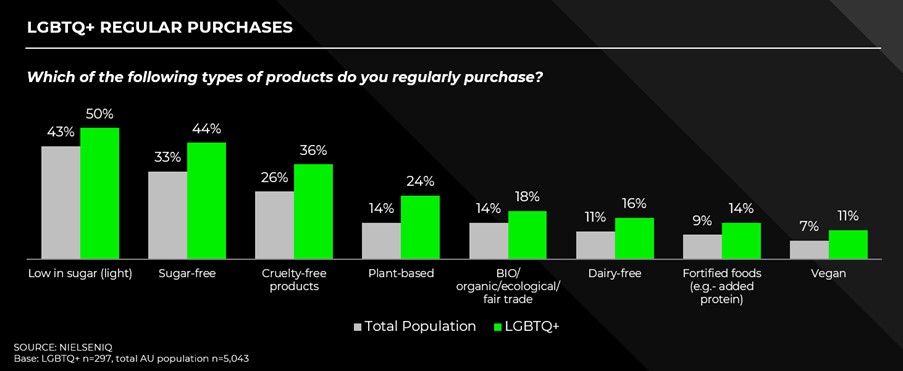

The NielsenIQ research also found that LGBTQ+ households are more likely to be vegan, vegetarian or have special dietary needs.

“The Australian LGBTQ+ community is very health conscious compared to the rest of the population,” says Ms Treston. “They demonstrate a strong commitment to following diets and are more likely to live a vegan or vegetarian lifestyle.”

Close to 40% of LGBTQ+ households responded positively to buying products that claimed health benefits followed by weight loss and animal welfare claims.

This community actively looks for information on labels such as low-sugar, sugar-free, cruelty-free, plant-based, and organic products while making purchasing decisions.

Importance of the research

NielsenIQ conducted the survey of Australian households in Q1, 2022 to better understand LGBTQ+ consumers.

Ms Treston says the unique research raises the voices of important demographic groups in Australian society and reinforces NielsenIQ’s commitment to presenting the true picture of Australia’s diverse grocery consumers.

“Our unique ability to segment and tap into this critical and growing consumer group via our Homescan Panel allows retailers and brands to better understand the size, differences in how they shop and how best to connect and engage with them,” she says.