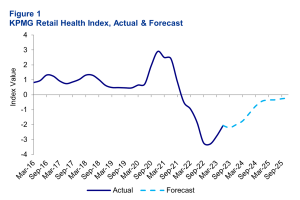

Modelling from KPMG Australia’s new Retail Health Index (RHI) indicates the sector will be unlikely to return to pre-pandemic levels until late 2025, with discretionary retailers expected to be hit the hardest.

The new KPMG Retail Health Index provides a data driven perspective on the future health of Australia’s retail sector from the viewpoint of the businesses operating in the sector, considering data on retail sales volume, producer prices, retail sector wage prices and consumer sentiment.

“After almost three years of pandemic stimulus fuelled consumer spending, the RHI peaked in December 2020 at +3.0 despite Australia experiencing a raft of negative social and economic effects associated with Covid,” according to KPMG.

“Since then, the KPMG RHI has declined rapidly falling to a low of -3.3 in December 2022 before a small rise to -2.1 in June 2023. Currently the weakness in the RHI is being driven by the sharp fall in retail sales volumes, as the reality of higher interest rates and rental prices start to kick in and influence not only spending patterns but total spending as well.

“Household goods (-1.5% q/q) and Department Stores (-1.4% q/q) experienced the largest declines in spending activity during the quarter, suggesting ‘nice to haves’ are now being left out of the household shop.”

KPMG Head of Retail Lisa Bora says that a retail downturn will affect some retailers more than others.

“The continued weak sales volume will likely blunt the holiday shopping season highs of prior years and put more serious pressure on discretionary retailers”, explains Ms Bora.

“Retailers who are looking for an end of year boost through online sales events in October and November should be prepared for some variations in traditional sales peaks this year. Stockturn and inventory management will be key to navigating a more turbulent Christmas period.”

On top of softening consumer spending, strong retail sector wages growth (+3.9% y/y) and surging power bills of between 20 and 25% y/y for the east coast market have jacked up the cost of doing business for most retailers.

Retail Turnaround and Restructuring Services Partner James Stewart says the next two years for many retailers could be challenging but there will be light at the end of the tunnel for those with healthy balance sheets.

“In difficult retail trading conditions, you typically see those retailers with the strongest balance sheets come out on top, as cashflow becomes the focus when sales and margins get tight.

“Highly leveraged businesses run the risk of tripping debt covenants or struggle to fund their strategic investments. If retailers with little to no debt keep their foot to the floor, they can ultimately drive a long-term competitive advantage.”