Price competition is significant now, but expected to lose importance.

Convenience is now considered the number one influencer on retail development globally, according to GfK’s latest retail trend monitor of 544 retail professionals.

Ranked seventh most important influencer in the same survey two years ago, overall shopping convenience has even overtaken internet shopping – now in second position – as the top driver of retail development.

Convenience is expected to remain a key driver, although its influence is set to be matched by that of mobile communication. While currently ranked third most important influencer, mobile communication is expected to become the number one driver of retail development sooner or later.

Price competition, ranked second most important influencer of retail development in the same survey two years ago, is now ranked fourth. The impact of this factor is expected to further weaken. While 83 per cent of respondents in our survey think price competition has had a strong impact on current retail development, only 73 per cent believe it will be relevant in the future. In fact, price has become a hygiene issue for consumers, while convenience has emerged as both a way to achieve competitive advantage and differentiation for retailers.

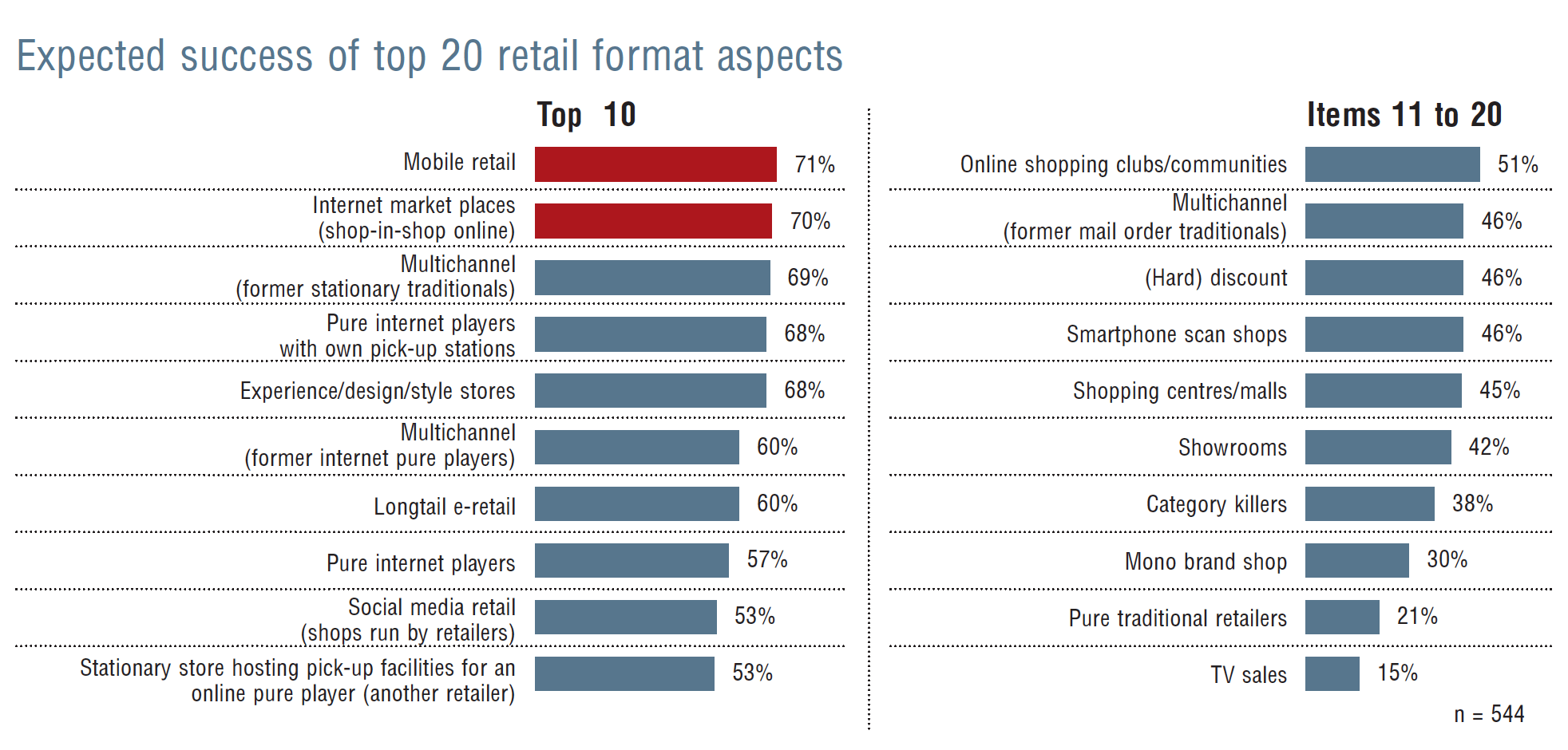

When it comes to future successful retail formats, those retail formats incorporating mobile retail solutions are expected to be most successful, with internet marketplaces ranking second. Global share of internet sales are expected to grow considerably, with estimated online sales share in some categories by 2030 estimated as:

- Downloads: >60 per cent.

- Technology consumer goods: >40 per cent.

- Fashion: >30 per cent.

The majority of retailers in our survey think mobile solutions such as location-based apps are an opportunity not only for attracting customers, but also researching their behaviour in-store.

In line with mobile concepts as a top future driver, 57 per cent of the retailers we spoke to consider location-based services an opportunity where the benefits outweigh the costs. However, 24 per cent of retailers were still unfamiliar with location-based services.

As consumers embrace the convenience of new ways of shopping, including immediate access to retailers and products offered by smartphone or other mobile devices, retailers increasingly need to enhance their formats with smart mobile solutions to capitalise on shoppers’ thirst for an increasingly connected shopping experience.

Successful retailers will be those that make shopping a convenient part of people’s lives.

About Retail Trend Monitor

Retail Trend Monitor is a global biannual survey of retailers and retail industry experts from more than 60 countries. The 2015 survey included 544 participants, split 50/50 between retailer and expert, including 93 participants from the Asia-Pacific region.

Norrelle Goldring

Head of Shopper

Insight & Retail

Strategy

GfK Australia

Norrelle specialises in improving shopping experiences by understanding how and why people buy things. She is a shopper, channel and category specialist with 20 years’ experience in FMCG and retail across manufacturer, retailer and agency roles with companies such as Diageo, Coca-Cola, Goodman Fielder and Vodafone. Norrelle is a national thought leader in the shoppermarketing discipline and has 14 years’ experience in shopper research. For more information contact:

M: +61 437 335 686

E: Norrelle.goldring@gfk.com

W: gfk.com/au

Twitter: https://twitter.com/GfK_en

GfK is the trusted source of relevant market and consumer information that enables its clients to make smarter decisions. More than 13,000 market research experts combine their passion with GfK’s long-standing data science experience. This allows GfK to deliver vital global insights matched with local market intelligence from more than 100 countries. By using innovative technologies and data sciences, GfK turns big data into smart data, enabling its clients to improve their competitive edge and enrich consumers’ experiences and choices.