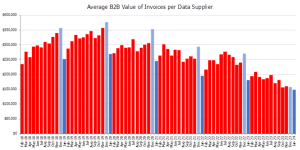

The January 2024 CreditorWatch Business Risk Index (BRI) has revealed the average value of B2B invoices is now at a record low, reflecting the continuing contraction of business activity.

Trading activity traditionally dips from December to January, but the average value of invoices is down 19% compared to January 2023. The usual spike in trading in December also failed to eventuate. This will be problematic in 2024 for those businesses that rely on a lift in trade pre-Christmas to get them through the rest of the year.

CreditorWatch forecasts trading conditions to become even tougher for businesses throughout 2024 with business and consumer confidence remaining subdued while input costs remain elevated.

Data source: CreditorWatch trade receivables data (accounting software integration).

This drop in order values is consistent with the subdued Christmas trading period experienced by retailers, which saw sales plunge 2.7% from November to December as cost-of-living pressures squeezed consumers. Instead of the traditional Christmas-trading spike in December, spending in department stores for December was actually at its lowest point since June. Cafes and restaurants also saw a decline in trade towards the end of the year rather than the expected uplift.

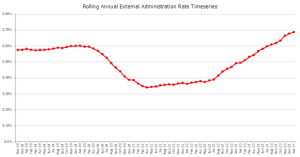

The rate of external administrations continued to rise in January, with business failures now sitting well above pre-Covid levels and showing no signs of tapering off.

Data sources: CreditorWatch Business Risk Index.

CreditorWatch CEO Patrick Coghlan says the deterioration in trading conditions indicates 2024 will be an extremely challenging year for Australian businesses.

“The retail trade numbers for December clearly showed that interest rate increases and high inflation are now exerting a huge amount of pressure on households, which translate to lower demand for goods and services,” he said. “Our hope is that interest rate relief arrives sooner rather than later to ease cost-of-living pressures and stimulate demand.

Key Business Risk Index insights for January:

- Average value of invoices for Australian businesses is down 19% year-on-year.

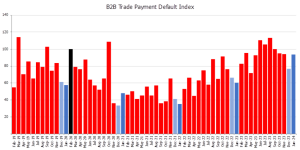

- B2B trade payment defaults continue to trend upward, with a 55% year-on-year increase.

- External administrations are now sitting consistently above pre-COVID levels.

- Credit enquiries have declined significantly in recent months as trade activity slows.

- Court actions are returning to pre-COVID levels. For our latest observed month, November 2023, they were at their highest point since April 2020.

- Businesses in the food and beverage services sector remain the most at risk of payment defaults (5.88%) by a considerable margin. Public Administration and Safety is the next riskiest industry at 5.14%, followed by Accommodation (5.09%).

- The regions with the lowest risk of business failure are concentrated around regional Victoria, inner-Adelaide and North Queensland. Ballarat, in regional Victoria, is the top-ranked region, followed by Norwood-Payneham-St Peters and Unley in South Australia.

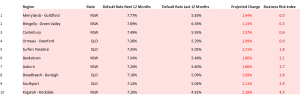

- The regions with the highest risk of business failure are around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) the top-ranked region, followed by Bringelly-Green Valley and Canterbury, all in Western Sydney.

- On a quarterly basis, the best performing region is Nundah, in inner-Brisbane, which moved 18.4 points up the index, while Stonnington-East in inner-Melbourne recorded the biggest slide down the index of 15.1 points.

CreditorWatch Chief Economist Anneke Thompson says the January 2024 BRI data is reflective of industry surveys which continue to record low levels of consumer sentiment, and falling levels of business sentiment.

“It is looking increasingly likely that the first half of 2024 will be some of the most challenging operating conditions many businesses will have ever experienced,” she said.

B2B trade payment defaults

In a continuing worrying sign for the economy, B2B trade payment defaults were at a very elevated level for January, and are in fact 55% higher than they were in January 2023. This means that businesses are becoming increasingly impatient with late payments, and are taking action by lodging payment defaults against these late payers. Cash flow is ever critical in a high interest rate environment, particularly when cash buffers of many businesses will have also been run down.

Data source: CreditorWatch Trade Payment default data (lodged defaults)

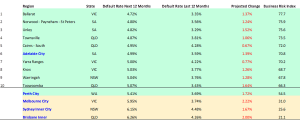

Best regions and capital cities (5,000+ businesses)

The regions with the lowest level of business insolvencies are scattered around the country. However, a commonality among these areas is that most of them have older populations, and therefore older businesses that will have lower levels of debt and more established customer bases. Areas with an older than average population will also have residents that are less likely to have mortgages, and therefore likely to be able to maintain higher levels of discretionary spending.

On the flip side, the regions with the highest levels of insolvencies tend to have very young populations, where discretionary spending amongst the population will have been hugely impacted by rising interest rates.

Best performing regions (5,000+ businesses)

Data sources: CreditorWatch Business Risk Index and ABS.

Worst performing regions (5,000+ businesses)

Data sources: CreditorWatch Business Risk Index and ABS.

Predicted business failure rate by industry

The industries with the highest probability of business failure over the next 12 months are:

- Food and Beverage Services: 5.88%

- Public Administration and Safety: 5.14%

- Accommodation: 5.09%

The industries with the lowest probability of default over the next 12 months are:

- Agriculture, Forestry and Fishing: 3.03%

- Health Care and Social Assistance: 3.61%

- Financial and Insurance Services: 3.78%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months.

The food and beverage sector confronts a number of significant challenges sector over the next year. Australian diners are already spending less at cafes and restaurants than they were in the middle of 2023, and that is in an environment of high population growth. Clearly, there are many Australian households that are substituting eating out with eating at home. The public administration and safety sector is being impacted by elevated insolvency rates in the security sector, which tends to have a lot of smaller businesses that operate in a very competitive environment.

Outlook

The Federal Government’s move to reign in population growth through lower levels of student visas will have a major impact on the economy over the next year. On the positive side, we should see some relief in demand for rental properties, and this should lower rental inflation over time. However, on the other hand, the food and beverage sectors and retail trade will be negatively impacted by slower growth in organic demand, largely due to slowing population growth. These sectors are also reliant on overseas students for labour.