Australian ice-cream consumers have developed a more sophisticated palate, with category growth coming from non-traditional flavours, according to Nielsen.

Consumers are buying higher-priced ice-cream, as well as buying it more frequently, with a whopping 93 per cent of consumers having bought it in the past year.

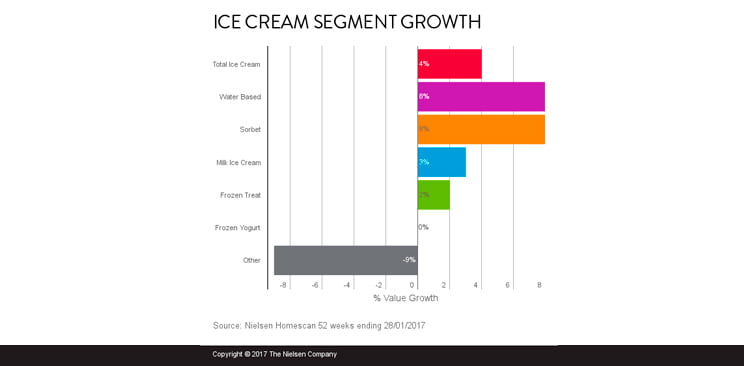

Dairy-based ice-cream is still the largest segment, contributing more than two thirds to the category, but the non-dairy sector, including water-based ice-cream and sorbet, is driving much more significant growth overall.

Australian consumers seem to have developed a more sophisticated palate, with category growth also coming from non-traditional flavours, including raspberry and white chocolate, rhubarb and custard, and blood orange. In fact, 62 per cent of the category’s total dollar growth came from flavours outside the top 20.

This is a reflection of the growing trend in premium, ‘indulgent’ ice-cream flavours. Nielsen’s Global Premiumisation Survey shows that almost a quarter (23 per cent) of respondents in Australia say they would consider buying or spending more than average for a premium product in the dairy category.

Everyone across all life stages has bought more ice-cream in the past year, though the biggest contributor to the category was the sector of smaller (one-to-two people) households without children, ie, independent singles, established couples and senior couples.

When it comes to the type of ice-cream people are buying, tubs and sticks are the most popular, with more households buying four, six and 24 packs in the past year. Sticks and bars, however, have shown strong value-sales growth over the past year.

Nielsen says opportunities remain for established brands in the premium space. By leveraging their infrastructure and retail partnerships, big companies in particular are uniquely positioned to reach a large consumer base with premium offerings.