The retailer’s ‘price drop’ campaign is in place. but supermarket sales increases are a mid-term proposition.

By David Burton.

Woolworths’ previously advised lower margin set for the supermarket division turnaround in Australia has been accelerated through investment in price in the first quarter of FY16, according to outgoing Woolworths group CEO Grant O’Brien.

“We’re encouraged that our investment is being recognised by customers with a consistent improvement in key customer metrics like Net Promoter Score [NPS] since the beginning of the year,” he said.

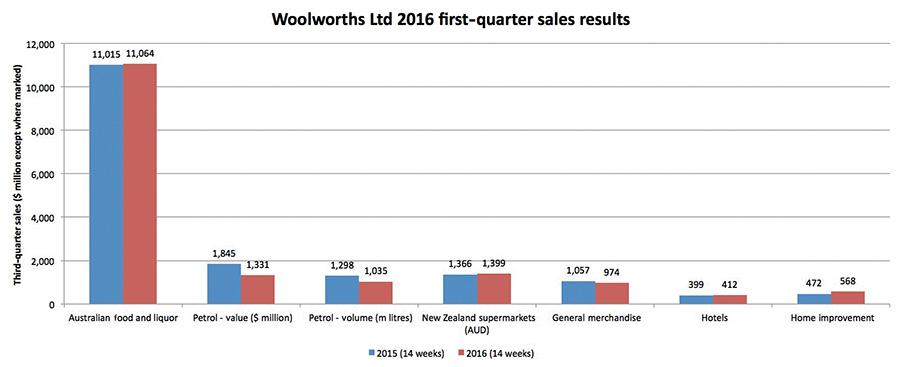

Mr O’Brien was commenting on the company’s first-quarter sales result, announcing sales of $15.7 billion, up 0.8 per cent on the previous year, excluding petrol. With petrol included, sales decreased by 2.5 per cent, but the impact of changes to the Woolworths-Caltex alliance and declining fuel prices were among mitigating factors The Australian food and liquor division’s sales for the quarter were $11.1 billion, an increase of 0.4 per cent on the previous year. At the

FY15 results announcement, Mr O’Brien had indicated that comparable food and liquor sales had declined by 0.9 per cent for the first eight weeks of FY16. The remainder of the quarter continued at a similar rate with comparable-store sales for the quarter declining by one per cent.

Food, liquor and petrol

still the mainstay Woolworths’ supermarket division has invested an additional $100 million in the quarter to deliver its price promise to customers.

This is supported by the latest marketing campaign with its ‘price drop’ and ‘low price always’ messages to communicate Woolworths’ position in the market.

According to Woolworths, “improvements in key customer metrics – including NPS, value perception and service since the beginning of the year – give us confidence that the progress we’re making is being recognised by our customers”.

Woolworths Managing Director, Australian Food and Liquor, Brad Banducci said: “We’re resetting our food business to ensure a sustainable leadership position and maintain strong returns to shareholders. We’re focused on our strategy to get customers to put us first as we invest in price, service and loyalty.” At an analyst briefing after the results were announced, Mr O’Brien said Woolworths was measuring prices in the quarter against those in the previous quarter while identifying separately the item of dealing with the price inflation in meat.

He noted that the cost of beef to Woolworths had risen by around 50 per cent this calendar year and this inflation was being absorbed rather than being passed on to customers. He is talking about the tens of millions of dollars that customers are saving.

Commenting on observations that the price investment had not yet resulted in increased sales, he said that to see recovery in sales would take some time and the supermarket team under Mr Banducci was focused on the lead indicator, which was around customer satisfaction.

Mr O’Brien said Woolworths had quite clearly identified to the market that this is a multiyear program.

“Obviously, there’s been an impact on our top-line sales through the quantum price of the investment that’s been invested in price,” he said.

Caltex alliance changes hit petrol sales

The retailer said petrol sales for the quarter were $1.3 billion, impacted by the previously advised changes to the Woolworths-Caltex alliance, after which sales from Caltexoperated sites have no longer been recognised by Woolworths.

This factor was aggravated by a 10.6 per cent reduction in average fuel-sell prices.

Comparable sales (dollars) decreased by 12.2 per cent and comparable volumes by 2.3 per cent.

The good news is that Woolworths reported premium fuels and diesel continuing to show strong growth, albeit offset by lower-grade fuels and LPG.

Merchandise sales brought growth of 10 per cent for the quarter. On a comparable basis, the sales increase was still a healthy 7.2 per cent, driven by strong in-store promotions and seasonal product.

BIG W sales decline

BIG W has been underperforming compared with arch rival Kmart for some time now – since the decision was made to reinvent its format. The man specially recruited to do so, Alistair McGeorge, is no longer there and Woolworths will need to find the right permanent replacement for the role.

Meanwhile, under acting chief Penny Winn, sales for the quarter decreased 7.9 per cent on the previous year, with comparable sales decreasing 8.1 per cent, but the sales trend improved as the quarter progressed.

The in-stock position normalised with the impact of BIG W’s business transformation and systems-implementation issues now largely resolved.

Woolworths noted that a number of categories performed well – party, books, baby consumables, sleepwear and underwear – with solid sales of new-season fashion. Sales trends further improved in October.

Masters new-format stores perform above average

Home-improvement sales for the quarter were $568 million, an increase of 20.3 per cent on the previous year. This was broken down into Masters sales for the quarter of $294 million and the home, timber and hardware division sales of $274 million.

Four new Masters stores in the new format opened during the quarter, alongside one retrofit. FY15 new stores continue to exceed the average sales per store of those in the original format by more than 30 per cent.

Home, timber and hardware sales for the quarter were up 17.1 per cent on the previous year, driven by sales from recent store acquisitions.