Supermarkets and Priceline are doing battle for the Australian cosmetics market, says Roy Morgan – and Priceline is gaining the edge.

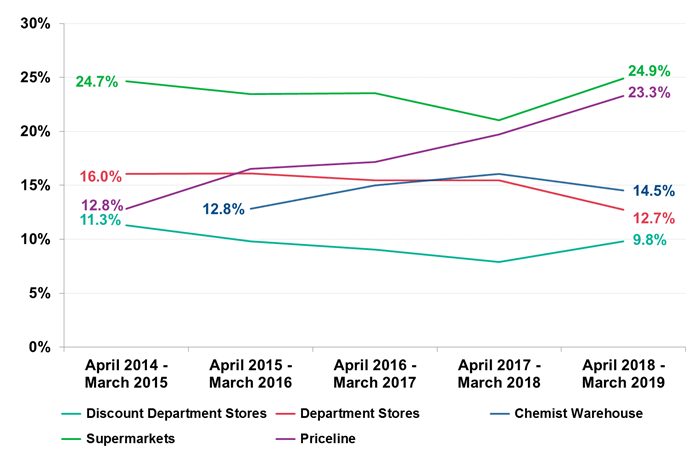

According to Roy Morgan’s latest data, Priceline has continued to grow its market share. Now, almost one in four Australian women (23.3 per cent) who buy cosmetics buy from Priceline, up from 12.8 per cent four years ago.

In fact, during this period, the number of women buying cosmetics at Priceline has rocketed from about 620,000 to more than 1.2 million in the year to March 2019.

Priceline’s success has come at a time when Australian women are increasingly buying their health and beauty products online. In the year to December 2018, according to Roy Morgan, 26 per cent of Australian women who buy cosmetics bought them from websites. This represents a rise of eight percentage points in four years.

One in four buy cosmetics from supermarkets

Supermarkets have stabilised their customer base for cosmetics after a dip in recent years. Nearly a quarter of Australian women (24.9 per cent) who buy cosmetics buy them from supermarkets.

Both Coles and Woolworths have experienced a higher number of customers buying their cosmetics compared with four years ago.

But not all retailers are faring so well. For instance, fewer women than four years ago are now buying cosmetics from leading department stores such as Myer and David Jones. And, at the other end of the market, discount department stores such as Target, Big W and Kmart have also experienced falls in market share.

Surprisingly, even Chemist Warehouse has experienced a small slump in cosmetic customers in 2019, after years of strong growth.

A unique battleground?

Roy Morgan CEO Michele Levine says the sheer number of players in the cosmetics market makes the competition particularly fierce.

“The cosmetics industry is a very competitive one,” she said. “Pharmacies and chemists, supermarkets, department stores and discount department stores are all vying to increase their share of the market.

“Supermarkets have recovered some of their lost market share over the past year. Woolworths is attracting an older cosmetic market to its stores. Coles is increasing the number of younger customers buying its cosmetics from its well-lit aisles.”

Ms Levine also paid tribute to the “staggering” success of Priceline in growing its market share.

“Priceline is enjoying its fifth straight year of growth,” she said. “This is fuelled by a hardcore base of 18-24 year-olds and a successful use of the growing online channel.

“Staggeringly, 41.5 per cent of 18-24 year-old women who bought a cosmetic product in an average six months buy a cosmetic product from Priceline.

“No other retailers are seeing even close to this level of market power over a particular age group.”